Eliminating the stress of subscription creep through an integrated management tool for Redwood Credit Union

OVERVIEW

As the subscription economy grows, Redwood Credit Union members are increasingly struggling to manage a complex web of recurring charges that often lead to unexpected fees and frustration.

Role

Solo UX/UI Designer

Timeline

February - April 2025 (12 weeks)

PROBLEM

Redwood Credit Unions members are failing to manage recurring payments

54% of members are losing money paying for subscriptions they don't use and are overwhelmed by the cognitive load of recurring payments. While 73% of them want a central way to track and manage these payments, Redwood Credit Union’s current digital tools lack the features to bridge this gap.

SOLUTION

Clarity and control are key

1

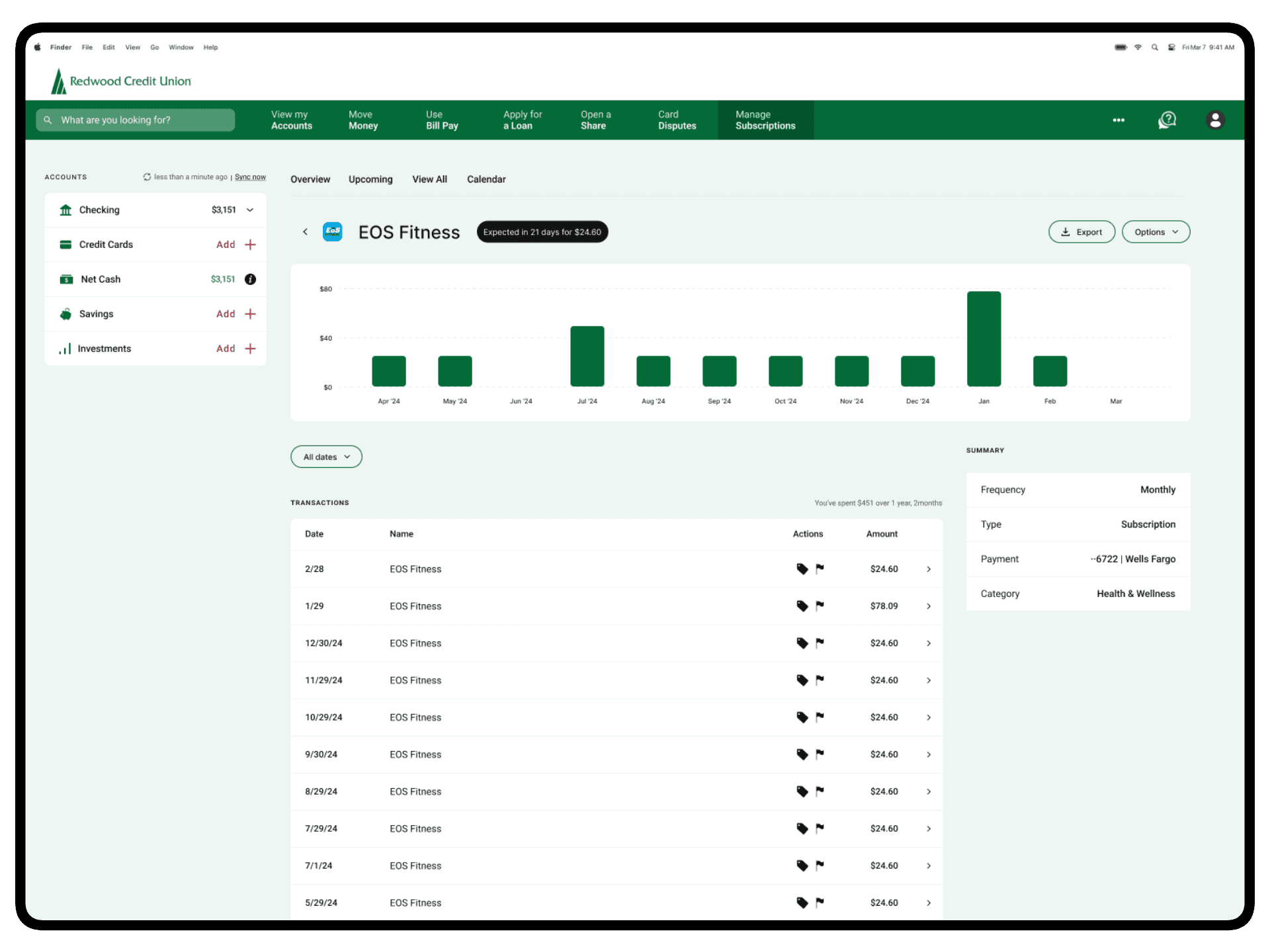

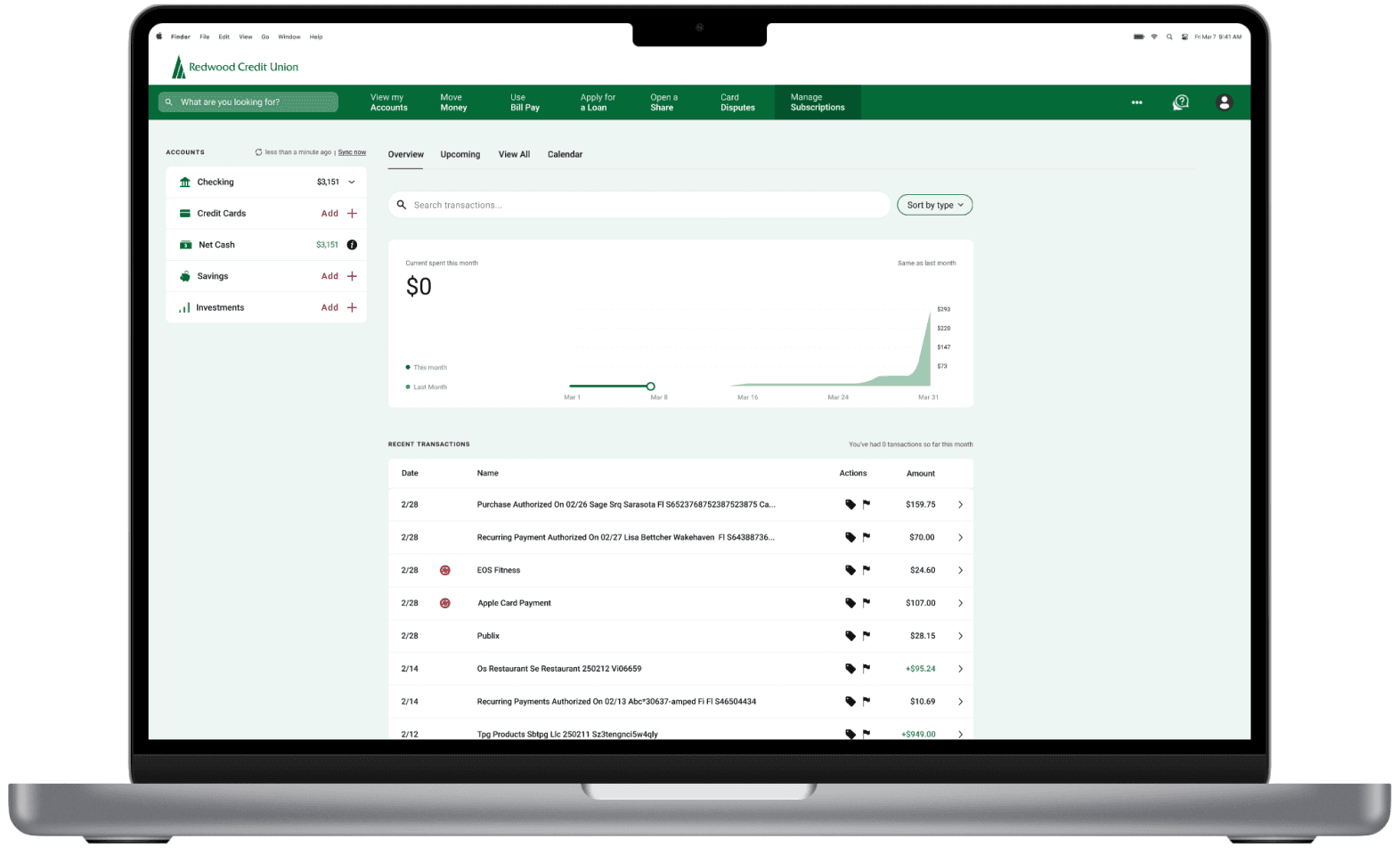

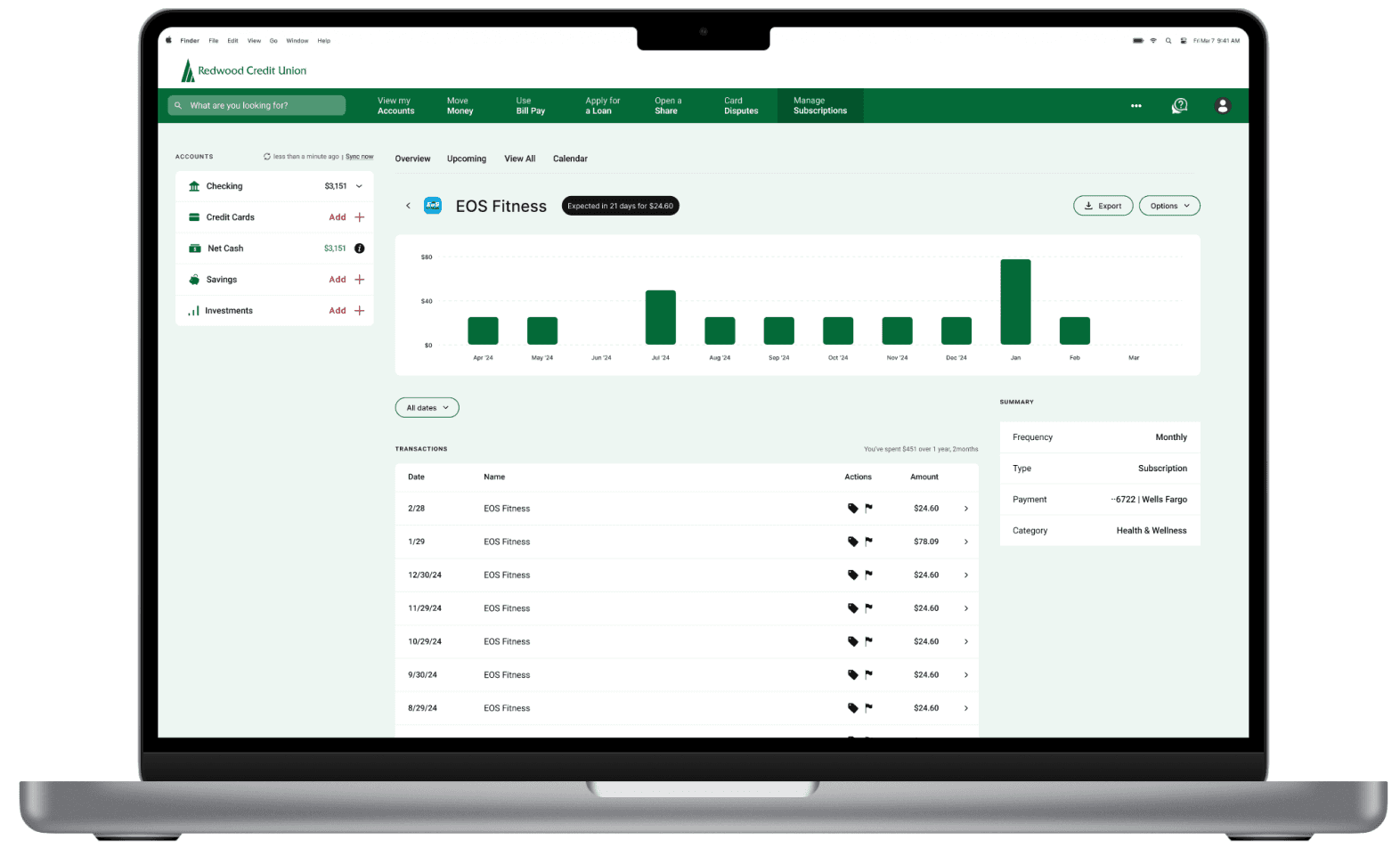

Recurring payment aggregator

All recurring payments are categorized

Accounts and amounts easy to view

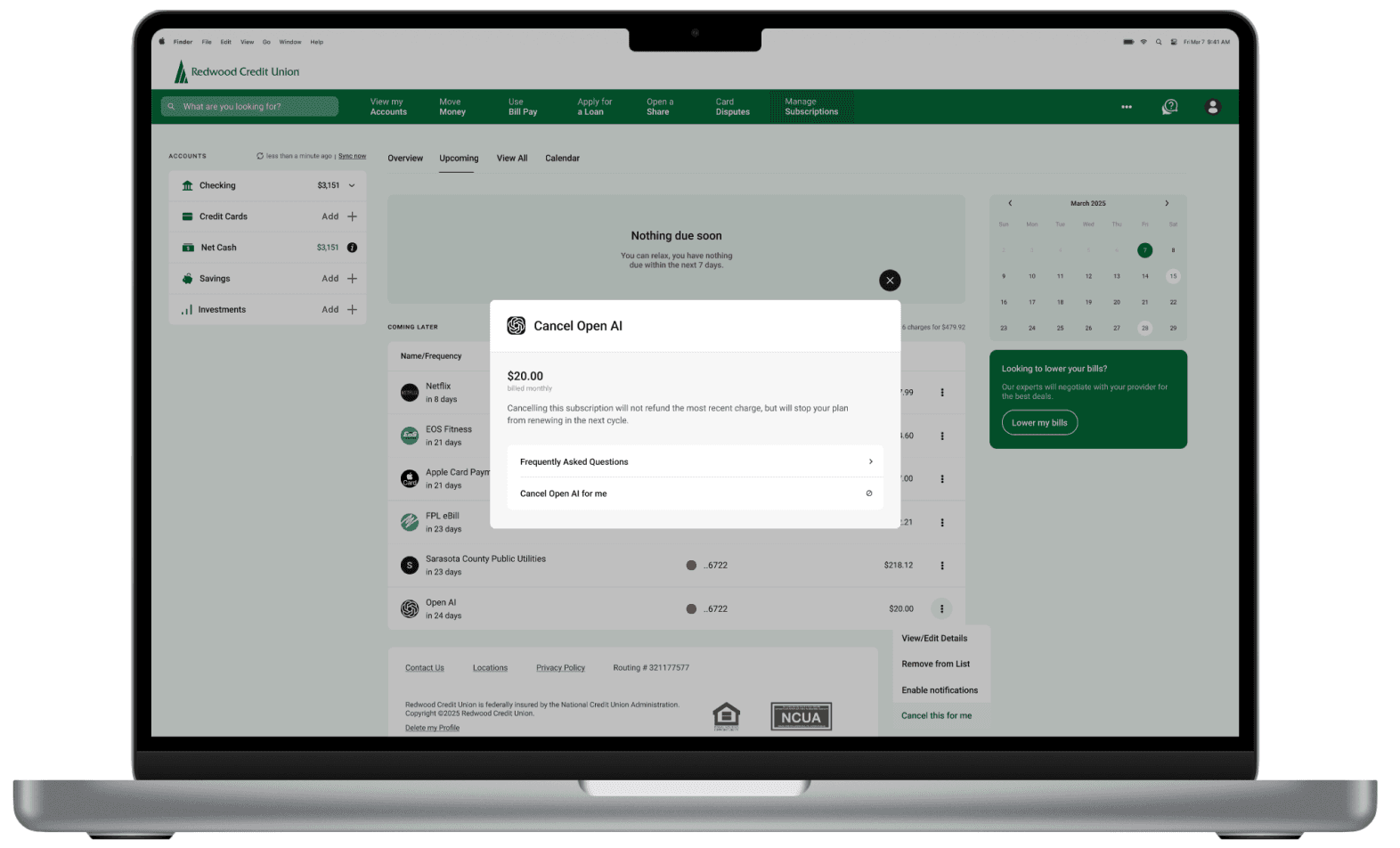

Direct easy cancelation

Direct cancellation made easy

View subscription history and totals spent

Native cancellation or negotiation

Visual spending charts for clarity

2

3

Calendar view for visual clarity

Due dates and amounts mapped visually

Quick actions are easily accessible

Provides users with a sense of agency and control

competitive analysis

Competitors are profit-driven trackers, not native financial partners

Looking at four of the most used subscription apps, I found they offer great features and data, but fail to capture user trust and reduce cognitive load.

Mint

Trim

Rocketmoney

Bobby

user interviews

Members struggle to control invisible costs of fragmented subscriptions

I interviewed 5 RCU members to try and gather qualitative insights about their financial tracking habits, pain points, and expectations.

Research questions:

How do you track your recurring payments?

Where do you encounter the most frustration?

How do subscriptions affect your budget and financial goals?

Are there privacy concerns about flagged data?

What would empower you to feel in control?

The main insight

My interviewees lose financial agency because they rely on mental inventory

Based on the trends in my affinity map, I've noticed how without an organized system, members will just mentally track expenses in their head and react to issues after the damage has been done.

Loss of agency

Members feel a loss of control due to the invisibility of automated payments.

They prefer manual payments for the added security.

Participants universally trust RCU over a third party apps.

Cognitive Load

Mental tracking leads to lack of clarity and constant stress.

They are caught off guard by longer billing cycles and irregular charges.

Checking account summaries can be overwhelming.

Financial blind spots

All members wanted a native tracking tool.

Individual charges obscure totals spent over time.

Without alerts, members continue to pay long after they have forgotten.

the novice gardener persona

28 Years Old | Marketing Coordinator

User Story

Hi! I'm Rebecca. I stay on top of my recurring payments because I prefer manual control, but missing cancellation deadlines is a real pain. I find myself checking my banking app 'an ungodly amount of times per day' just for reassurance. I'm not looking for a complicated new tool to pay for, I just want a simple way to make sure I’m not wasting money on things I don't use.

Goals

Cancel unused subscriptions easily

Less financial stress and worrying

Stay on top of her payments

Motivations

Doesn't want complicated tools

Prefers to manually make payments

She cancels quickly if not finding value

Pain Points

Forgets to cancel free trials

Time consuming to manually check finances

Different accounts paying for subscriptions cause chaos

Feels out of control with too many subscriptions

Testing + improvements

Three major improvements in my design

After two rounds of testing with ten participants, I iterated on the design over the next 2 weeks - with 3 major improvements:

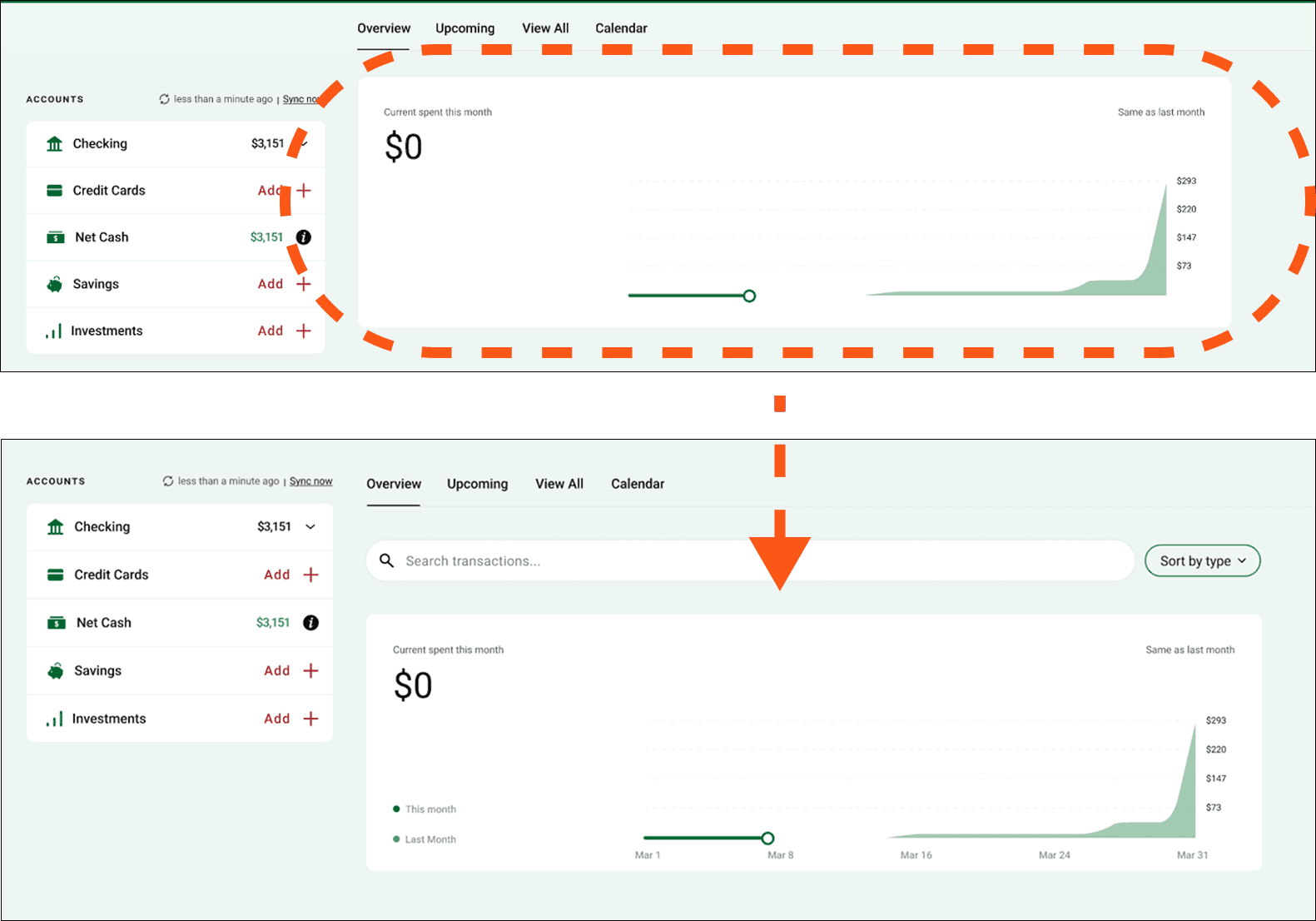

Expanded key actions

Based on user testing 60% of users expected to cancel from the options CTA

Added cancellation and notifications options to the details page

1

2

Clarified graph data

Testing revealed that users were unclear about the overview graph

Added more information to the x-axis and labels

Post action confirmation

Users hesitated initially with navigation within the feature

I differentiated the navigation bar to make it more clear

3

The final screens

The final product

conclusion + lessons learned

The main takeaways from the project

Accessibility is not optional. Testing with a wide range of users (ages 30-75) made me realize that while one group can navigate with ease, others need more visual clarity and simplified navigation.

Data should be actionable, not just visible. Simply seeing charges and aggregated data are nice, but they do nothing to address the key friction of feeling out of control and overwhelmed. Giving users agency through key actions helps solve their underlying anxiety.

Trust is the biggest differentiator. Leveraging the inherent trust that users had with RCU was a major reason for proposing this feature, as it leads to more member retention without privacy friction that third party apps would have.

© 2026 Vincenzo Stornaiuolo. All Rights Reserved.